louisiana estate tax return

Who is required to file an estate transfer tax return. However if the estate or trust derived income from louisiana sources the filing of a louisiana fiduciary income tax return is required.

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Fiduciary Income Tax Who Must File.

. E-File is available for Louisiana. When I try to work with the form. Just because Louisiana doesnt have an estate tax or inheritance tax doesnt mean youre in the clear as far as the IRS.

Can real estate taxes be deducted in Louisiana. Louisiana residents now have until July 15 2020 to file their state returns and pay any state tax they owe for 2019. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

The eSmart Tax online tax return filing solution makes it easy to efile your Louisiana state tax return using the correct state tax forms. There is no louisiana inheritance tax for people who died on or before june 30 2004 and an inheritance tax return was not filed before july 1 2008. I cant seem to figure out how to answer line 9 of La Form IT-540 Federal Income Tax.

Filing Estate and Gift Tax Returns When to File Generally the estate tax return is due nine months after the date of death. A tax rate of 6 06 is assessed on the total distributive shares for nonresident partners included on the Louisiana Composite Return. BATON ROUGE The filing and payment deadline for 2021 state individual income tax is Monday May 16.

The federal estate tax exemption was 1170 million in 2021 and increased to 1206 in 2022. A six month extension is available if requested prior to the due date and. Estates and trusts located outside the United States may elect to be taxed on total gross income from Louisiana sources at the rate of 5.

1 Total state death tax credit allowable Per US. June 1 2019 139 AM. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case when an.

Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceaseds net estate is 6000000 or more. I cant find any question about it in the questionnaire. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only.

Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. Prepare your full-year resident Louisiana state tax.

Preparation of a state tax return for Louisiana is available for 2995. Federal Estate Tax. Filing Deadlines Find out when all state.

Does Louisiana Have an Inheritance Tax or Estate Tax. The exemption is portable for married couples. Louisiana State Income Taxes for Tax Year 2021 January 1 - Dec.

INSTRUCTIONS FOR COMPLETING FORM IT-541. 1 Best answer. The federal estate tax exemption was 1170 million in.

Louisiana Department of Revenue Taxpayer Services Division P. Where do i enter. Though Louisiana wont be charging you any estate tax the federal government may.

As with the federal deadline extension Louisiana wont charge. Taxpayers can file their returns electronically through. How is estate transfer tax calculated.

Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal. An inheritance tax is a tax imposed on someone. Direct Deposit is available for Louisiana.

Yes real estateproperty taxes should be deducted as a rental property expense on. May 9 2022. Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day.

Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must.

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Why Some Americans Should Still Wait To File Their 2020 Taxes

Understanding The 1065 Form Scalefactor

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

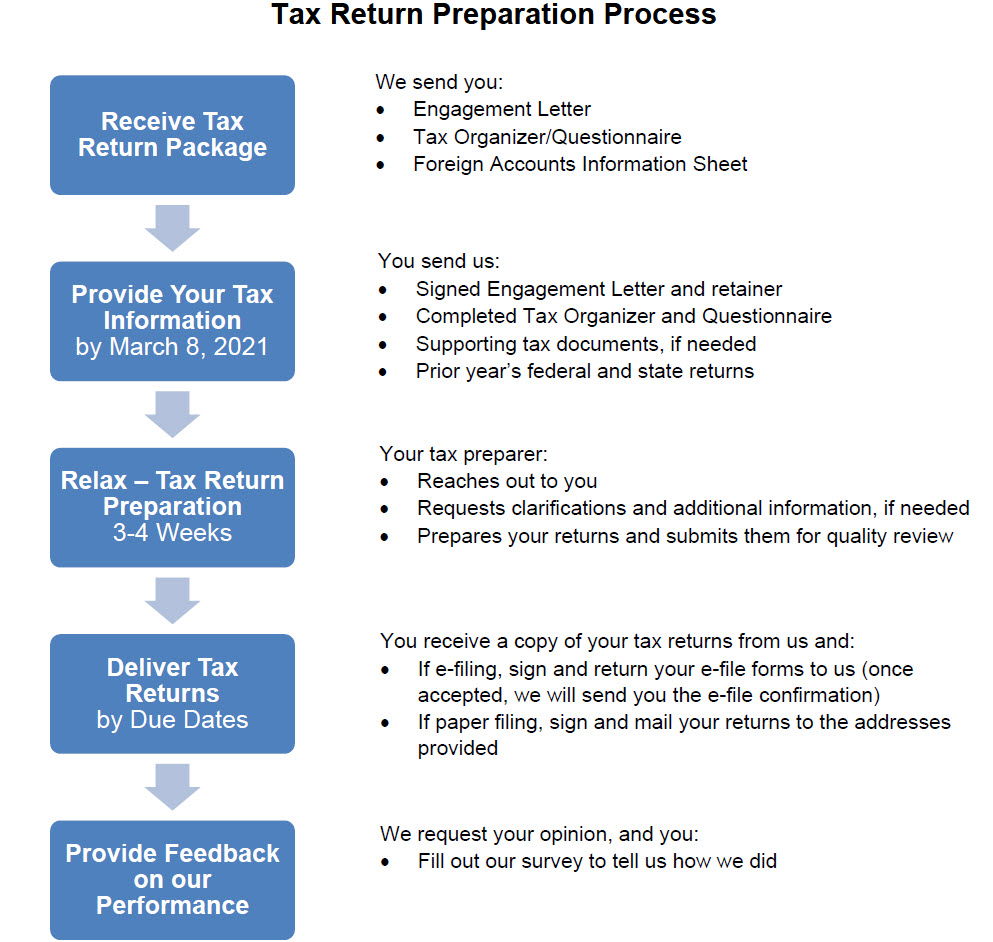

Tax Return Information The Wolf Group

5 Ways To Get Approved For A Mortgage Without Tax Returns

Louisiana Succession Taxes Scott Vicknair Law

Tax Return Refund Delays From The Irs Leave Triangle Residents Waiting For Thousands Of Dollars Abc11 Raleigh Durham

How To File Taxes For Free In 2022 Money

Preparing To File Your Federal Tax Return Regions

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Investment Property Expense List For Taxes Investing Investment Property Being A Landlord

Will The Irs Extend The Tax Deadline In 2022 Marca

Image Result For U S National Map Of Property Taxes Property Tax American History Timeline Usa Facts